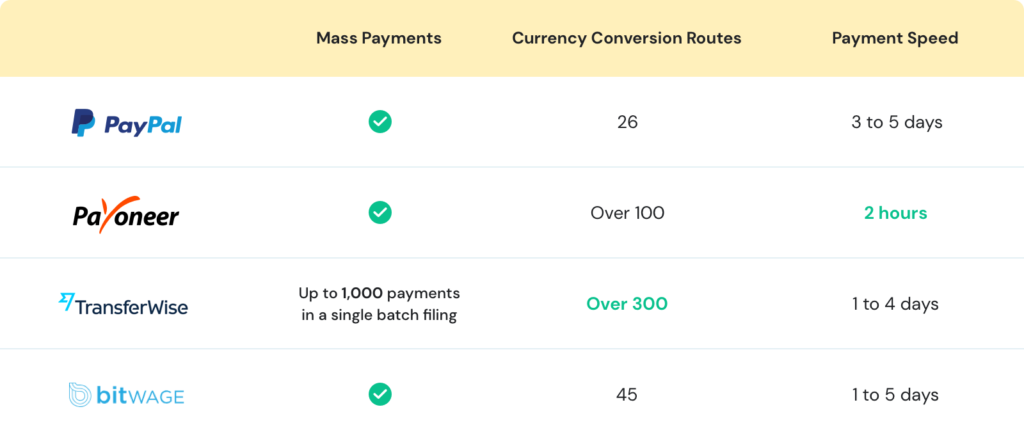

Considering its competitors like PayPal Transferwise Bitwage Payoneer is the fastest money transferring software. Loss of valuable money is almost inevitable.

Receive Your Cafetalk Earnings Via Payoneer

With Payoneer you save an average of 5 per transaction of 100 that is INR300.

Payoneer vs paypal rates. They take an average of 2 cut which can be much when you add up all your conversion transactions in the long run. PayPal also lets you send funds in many international currencies and they. But the big issue with PayPal is the conversion fee that stands at around 3-375.

PayPal is great at converting currency so its always proven an effective way of turning your Chinese RMB into US dollars. Payoneer is super accessible. Payoneers fees are also on the higher side but are lower compared to PayPal.

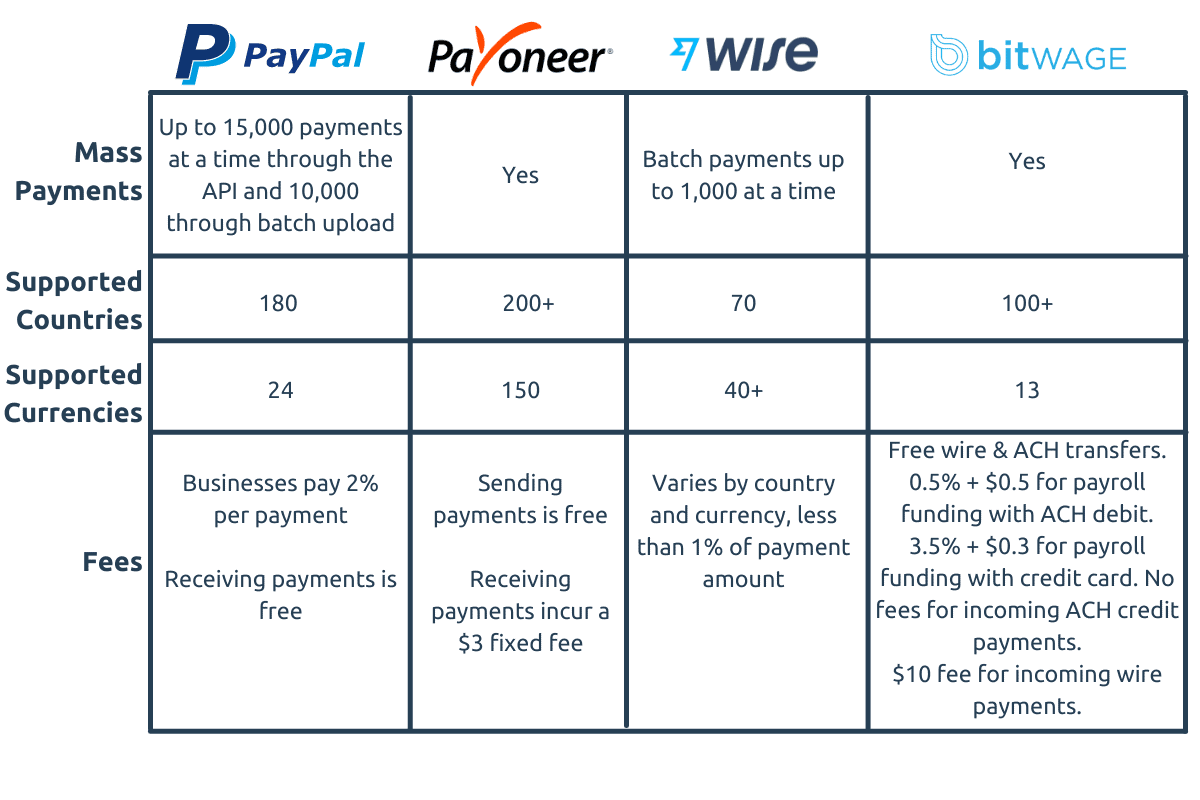

The main difference is in fees and the number of features they provide. PayPal is widely used and trusted by both businesses and individuals and has a fixed fee of 2 on payroll payments. Specifics of their pricing are mentioned below like Payoneer has not provided sufficient data regarding its payment options.

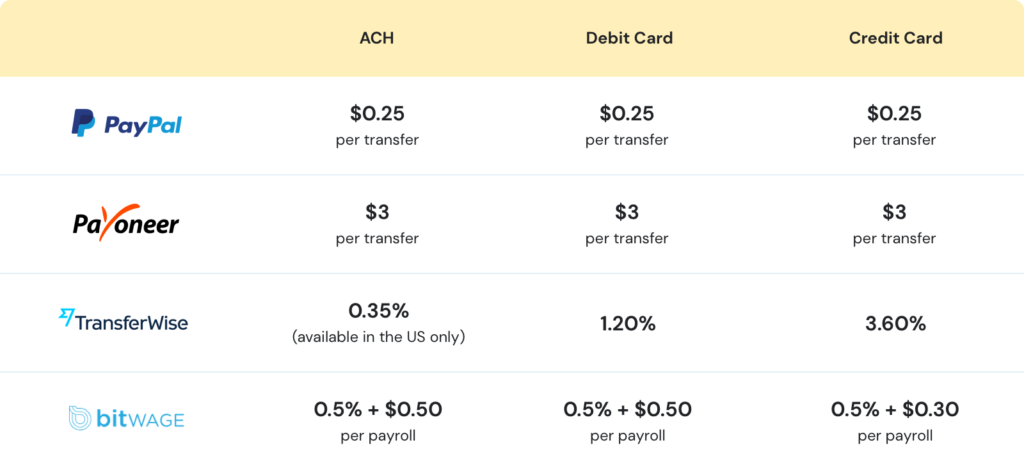

Ad Fast Online Money Transfers Anytime - Send It Today With Western Union. Well yes Payoneer is the fastest but is the most expensive as well. Payments through PayPal are more secure and come with lower fees than Payoneer transactions.

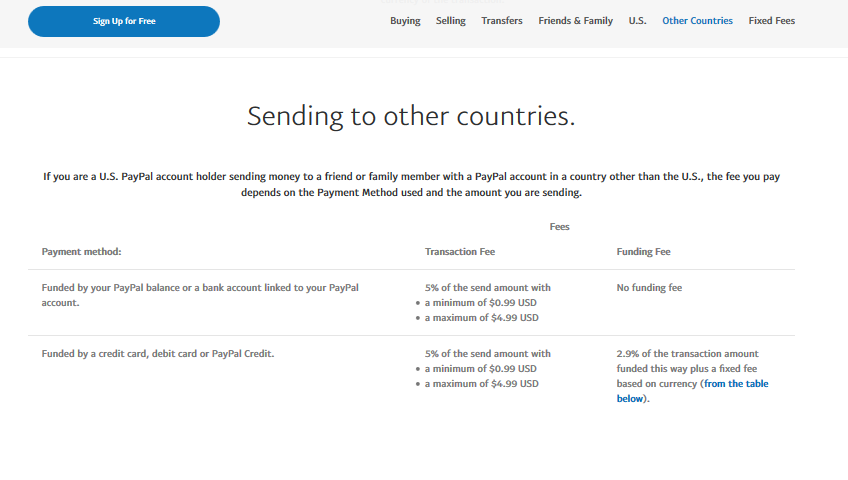

Which Is Right for Your Business in 2021. For the rest of the world the fees are 099 for anything 4999 and under 199 for transactions between 50 9999 and 399 for transactions 100 or more. Payoneer VS Paypal Comparison Speed cost support Countries Transferring money overseas is vital for expats and businesses that rely on international staff and freelancers but it can be a cumbersome confusing and costly experience.

However PayPal will opt to use its own exchange rate which sometimes shortchanges you they charge a fee of 44 plus an additional fee of 030 per transaction. Payoneer is definitely more profitable than PayPal The costliest average charges per transaction are 1488 while the cheapest are 155. With PayPal you can be assured that your funds are secured and charged at lower transaction rates than Payoneer.

The major difference between PayPal and Payoneer can be understood by studying the network relationships transfer charges and security. Depending on your business one might be a better or worse option for you. You can send professional invoices using both platforms.

Transfer speeds with PayPal occur within 1-2 business days while Payoneer transactions occur within 0-3 business days. PayPals larger network and international currency capabilities make it easy to send payments around the world. If you compare Payoneer vs.

Aside from that Payoneer transfer fees stay at a 3 flat rate per transaction. PayPal fees are higher compared to Payoneer which means that you can save a significant amount of money when you transact huge amounts of money with Payoneer. Whether you reside in India Bangladesh Ukraine USA or somewhere else you can as long as you are a freelancer or a business get the Payoneer card right away.

Weve added one more software Veem to this comparison to help you to choose the right software. PayPal and Payoneers primary differences are their network relationships security and transfer fees. Also receiving money through Payoneers receiving accounts solution has no cost.

Payoneers foreign exchange rates are superior to the ones offered by Paypal by a whole lot. In payoneer you may engage with more than 100 currencies however in PayPal it is just 30. Ad Fast Online Money Transfers Anytime - Send It Today With Western Union.

Whereas Paypal provides features like Monthly payment option. Sending money internationally through PayPal can cost far more than Payoneer. Differences between PayPal Payoneer Wise and Bitwage fees and comparison chart PayPal Payoneer Wise and Bitwage all have their pros and cons.

Paypal is probably one of the most expensive ways you could ever send money abroad. PayPal youd choose the former in terms of speed. For international money transfers PayPal charges 5 of the transaction when you send money directly to another PayPal account with a minimum transaction fee of 099 and a maximum of 499.

While the latters transfer process takes about two to four days Payoneer usually gets the. When converting from one currency to another Payoneer applies a rate that is much lower compared to other money transfer services. PayPals fees and exchange rate margins are high.

This shows that the variance is inclined to the costlier side ie. In this report we will compare Payoneer vs Paypal.

Payoneer Vs Paypal Which One Is Best Low Fees Other Benefits Blogbeginner

Payoneer Vs Paypal Which Is The Best Payment System Mythemeshop

Paypal Vs Payoneer Vs Transferwise Which Is Better Traqq S Blog

Payoneer Vs Paypal 2021 Which One Is Better Digino

Paypal Vs Payoneer Vs Wise Vs Bitwage A Comparison

Payoneer Vs Paypal Which Services Is Best For Money Transfers Latest Technology News Gaming Pc Tech Magazine News969

Payoneer Vs Paypal Which Is The Best Payment System Mythemeshop

Payoneer Vs Paypal Which One Should You Get Robots Net

Payoneer Vs Paypal Which One Is Best For You

Paypal Vs Payoneer Which One Has Lowest Fee Clashpanda

Paypal Vs Payoneer Vs Transferwise Which Is Better Traqq S Blog

Payoneer Vs Paypal With Comparison Table 2021 Which Is Better

Paypal Vs Payoneer Comparision

Payoneer Vs Paypal Detailed Comparison Payoneer India 2021 Review

Transferwise Vs Payoneer Which Is The Best Fees And Rates Compared

Payoneer Vs Paypal What Are The Differences

Paypal Vs Payoneer Which One Has Lowest Fee Clashpanda

Paypal Vs Payoneer Which Is Better Tricky Enough

Paypal Vs Payoneer Comparison Review Which One To Use 2021 Blogger Sprout